Bcg Matrix Of Reliance Pdf

The BCG Matrix (Growth-Share Matrix) was created in the late 1960s by the founder of the Boston Consulting Group, Bruce Henderson, as a tool to help his clients with efficient allocation of resources among different business units. It has since been used as a portfolio planning and analysis tool for marketing, brand management and strategy development.

In order to ensure successful long-term operation, every business organization should have a portfolio of products/services rather than just one product or service. This portfolio should contain both high-growth and low-growth products/services. High-growth products have the potential to generate lots of cash but also require substantial amounts of investment. Low-growth products with high market share, on the other hand, generate lots of cash while needing minimal investment.

How it Works

The BCG Matrix helps a company with multiple business units/products by determining the strengths of each business unit/product and the course of action for each business unit/product. An understanding of these factors will give the company the highest probability of winning against its competitors, since the intelligence generated can be used to develop portfolio management strategies.

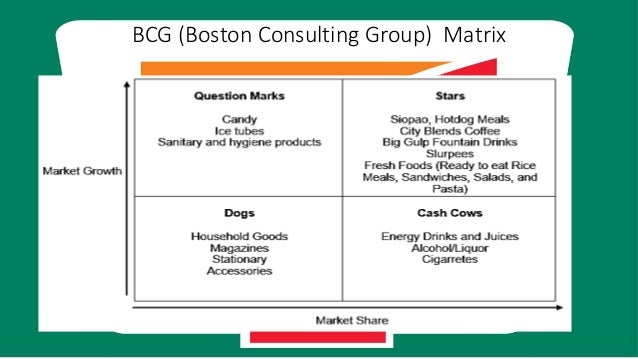

Introduction The Boston Consulting Group (BCG) is a renowned organization. It is a growth share 2×2 matrix. The matrix is established in 1970 by Bruce Doolin Henderson (1915–1992) for the BCG in Boston, Massachusetts, the USA. Henderson was the President and Chief Executive Officer (CEO) until 1980. He was also Chairman until 1985. BCG matrix helps in categorizing the products or the business units among four quadrants, which are; stars, cash cows, dogs and question marks. The analysis is done by considering two main aspects, which are, market growth and market share. The businesses are analyzed in this manner for the companies to make effective decisions (Hanlon, 2018). One of the tool is BCG Matrix. According to BCG matrix; Question mark are those segments which, operate in high sales growth industry and have low relative market share. DZIENNIK USTAW Z 2006R.NR 137 POZ.984 PDF. These are low growth or low market share products and have very few chances of showing any growth.

The BCG Matrix helps managers classify business units/products as low or high performers using the following criteria:

1. Relative market share (strength of a business unit’s position in that market)

2. Market growth rate (attractiveness of the market in which a business unit operates)

Relative market share (RMS) is the percentage of the total market that is being controlled by the company being analyzed.

This classification places business units/products in the following four categories:

1. Stars – BUs/products characterized by high-growth and high- market share. They often require heavy external investment to sustain their rapid growth as they may not be producing any positive cash flow. Eventually, their growth will slow, and they will turn into cash cows.

2.Cash Cows – BUs/products characterized by low-growth, high-market share. These are well established and successful BUs that do not require substantial investment to keep their market share. They produce a lot of cash to be used for other business units (Stars and Question Marks) of the company.

3. Question Marks – BUs/products characterized by low-market share in high-growth markets. They require a lot of financial resources to increase their share since they cannot generate enough cash themselves. The crucial decision is to decide which Question Marks to phase out and which ones to grow into Stars.

4. Dogs – BUs/products with low-growth, low-market share. In addition, they often have poor profitability. The business strategy for a Dog is most often to divest. However, occasionally management might make a decision to hold a Dog for possible strategic repositioning as a Question Mark or Cash Cow.

The BCG model follows the following major steps:

1. Identify major organizational business units (BUs) and identify RMS and MGR for each BU

2. Plot the BUs on the BCG Matrix

3. Classify the BUs as Question Marks, Stars, Cash Cows and Dogs

4. Develop strategies for each BU based on their position and movement trends within the matrix

Figure 1: An example of the BCG Matrix

Strengths and Weaknesses

Strengths of the BCG Model:

The BCG Matrix allows for a visual presentation of the competitive position of all units in a business portfolio.

The BCG model allows companies to develop a customized strategy for each product or business unit instead of having a one-size-fits-all approach.

Simple and easy to understand.

It works well for companies with multiple divisions and products

Allows for quick and simple screening of business opportunities in order to determine investment priorities in the portfolio of products/business units.

It is used to identify how corporate cash resources can be best allocated to maximize a company’s future growth and profitability.

Useful for the development of investment, marketing and operating decisions:

a. Investment in the business unit in order to build its market share

b. Sufficient investment to maintain the business unit’s market share at the current level

c. Determine which business unit/product will function as a cash cow to provide necessary cash flow for the other business units/products

d. Divest a business unit

Weaknesses of the BCG Model:

The BCG model assumes that high market share and market growth are the only success factors. Based on numerous real life examples, we can conclude that high market share does not always lead to profitability. Businesses with low market share can be highly profitable as well. Relative market strength is also determined by the following factors which the BCG does not take into account:

a. Technological competence

b. Ability to maintain low manufacturing costs

c. Financial strength of competition

d. Distribution capabilities

e. Human resources

- The BCG model focuses on major competitors when analyzing the relative market share of a company. However, it neglects some small competitors with fast growing market shares

- It is a rather short-term model that doesn’t fully show how characteristics of business units change over the long term.

- The BCG model is more focused on business units than individual products

- Assumes that high rates of profit are directly related to high market share

- The BCG model looks at a business unit in isolation without taking into consideration the possible cooperation among various business units within the organization

- BCG is a primarily qualitative model

- The Y axis represents the annual market growth which fails to see the full picture that goes beyond a one year span

- It does not take into consideration other important factors such as: market barriers/restrictions, market density, profitability, politics

- With this or any other such analytical tool, ranking business units has a subjective element involving guesswork about the future, particularly with respect to growth rates.

Application to Competitive Intelligence: Automotive Industry

The BCG model could be helpful in situations where big economic swings produce significant changes in the original classification of companies, BUs and products. For example, 10-15 years ago, the automobile manufacturers in the US dismissed the market for small economy cars in favour of big SUVs. At that time, small cars were considered Dogs while SUVs were Stars. That happened because car manufacturers did not take into consideration the important factors of rising oil/gasoline prices and the changes in the environmental consciousness of the society. What if the management of major car manufacturers in the US had ran the BCG model under different scenarios (high gas prices; increased environmental awareness) to decide which cars would be Stars and Dogs under each of those scenarios? We believe that doing so would have better prepared the individual players in the industry for the rising competition with foreign car manufacturers.

It is also important to constantly analyze business news to look at what other companies are selling/divesting or acquiring. If they are selling a product/BU with a small market share in a declining market then we know they are most probably selling a Dog. The question is why are they selling it? Do they need the cash to fund a new Star? If GM tomorrow announces that they are selling its hybrid vehicle division, does it mean that they are in possession of a new technology that will revolutionize the entire industry? Looking at the competition through the prism of the BCG Matrix would help managers ask the right questions and then collect necessary intelligence in the process of answering them.

The BCG Matrix could also be used by business analysts for the purpose of forecasting future trends. These analysts would analyze whole industries/technologies using the BCG Matrix in order to predict future changes. For example, business analysts at GM could develop various scenarios to predict the future of the automobile. With the price of oil and other commodities rising, they need to look beyond traditional technologies and sources of energy and evaluate other alternatives. From this point of view, the analysts could plot various traditional and breakthrough technologies on the BCG Matrix in order to determine the current Question Marks, Starts, Cash Cows and Dogs and forecast how the Matrix will change in the next 5-10 years under various scenarios (high inflation, scarcity of resources, change in consumer tastes and demands). Another application of the BCG Matrix in CI would be to see where the currently emerging technologies will be five years from now from the point of view of relative market share and market growth. Most of the breakthrough technologies today would appear in the Question Mark quadrant of the BCG Matrix. How will this picture change in 2-3 years from now? By monitoring and plotting these changes the business leaders at GM could get an insight into what will drive the future of the automotive industry in the future. In fact, in this context the BCG Matrix could become an important part of the business foresight which combines deep analysis of the past patterns and emerging trends with business insight. Those who are able to come up with the most accurate foresight and timely capitalization on it will be the future leaders in the industry.

GE/McKinsey Matrix

The GE/McKinsey Matrix was developed jointly by McKinsey and General Electric in the early 1970s as a derivation of the BCG Matrix. GE, by that time, had approximately 150 different business units and was disappointed with the profits derived from its investments. This raised internal concerns about the approach the organization had to investment decision making. While exploring new models to implement, GE started to be interested in visual strategic frameworks like the Growth-Share Matrix created by the Boston Consulting Group (BCG) a few years before. However, the BCG Matrix showed to have some limitations. It was considered not flexible enough to include all the broader issues that a company was facing while operating in a fast changing global environment. The GE/McKinsey Matrix solves most of the issues of the BCG model and proposes a more sophisticated and comprehensive approach to investment decision making.

How it Works

The GE/McKinsey Matrix is a nine-cell (3 by 3) matrix and it is primary used to perform business portfolio analysis on the strategic business units (SBU) of a corporation. A business portfolio is the collection of all the business units within a corporation and a large corporation has normally many SBUs. Each SBU is a distinctive and unique unit that falls under the same strategic hat. A well balanced portfolio is one of the top priorities of a large organization. The strategic business units are the basic blocks that compose a business portfolio. A unit can be a divisions or even a whole company owned by the parent organization.

Bcg Matrix Of Reliance Pdf File

The nine-box matrix provides decision makers with a systematic and effective framework for a decentralized corporation to make better supported investment decisions and for developing strategies for future product development or new market segment entries. Instead of looking solely at each unit’s future prospects, a corporation can adopt a multi-dimensional approach based on two components that will indicate how well the unit will perform in the future. The two components used to evaluate businesses, which also serve as the axes of the matrix, are the ‘attractiveness’ of the relevant industry and the unit’s ‘competitive strength’ within the same industry. Each axis is then divided into Low, Medium and High.

Figure 2: Factors that influence the axes of the GE/McKinsey Matrix

Six steps are necessary to implement the GE/McKinsey analysis:

1. Determine which factors are relevant for the corporation in the industry where it operates

2. Assign a weight to each factor

3. Score each factor

4. Multiply the relative scores and weights

5. Sum all up and interpret the graph

6. Perform a review / sensitivity analysis

The plotted circles convey the information in the following way:

The size of the circle represents the market size of the SBU

The share owned by the SBU is expressed as a pie slice with its relative percentage inside

The expected future direction of the SBU is represented with an arrow

The circles representing SBUs are then placed within the matrix. As a result, the executives of the corporation will have a clear and powerful analytic map for understanding and managing their entire multi-unit business. The units that fall above the diagonal indicate the investment and growth to be pursued; the units along the diagonal require a thorough analysis and individual selection for investment; finally the units below the diagonal might indicate divestments are necessary or otherwise that businesses can be kept only for cash reasons. The placement of the units within the matrix is a necessary first step before the analysis phase that requires human judgement can begin. For example, a strong unit in a weak industry is in a very different situation than a weak unit in a highly attractive industry.

Figure 3: An example of the GE/McKinsey Matrix

Strengths and Weaknesses

The GE/McKinsey Matrix, as an extension of the BCG framework, shares the aforementioned advantages of the BCG model. Though the GE/McKinsey Matrix is more sophisticated than the BCG matrix and can provide higher value information for the executive management, it has several flaws and limitations:

- No proven relationship between market attractiveness and business position.

- The relationships between different units are not taken into account.

- The core-competencies that lead to value creation are not taken into consideration.

- The approach requires extensive data gathering.

- Scoring is personal and subjective (risk of bias)

- There is no hard and fast rule on how to weight elements.

The GE/McKinsey Matrix offers a broad strategy and does not indicate how best to implement it.

For the above limitations and issues, the GE/McKinsey Matrix can serve more as a quick strategic visual framework rather than as a resource allocation tool.

Application to Competitive Intelligence: Apple Inc.

Apple Inc. is a large technology company with several business units operating in different markets, including desktop computers, laptops, tablet computers (iPads), portable music players (iPods), smartphones (iPhones) and software to support these products. A competitor wishing to gain competitive intelligence on the activities of Apple Inc. could do so by placing its business units into a GE/McKinsey Matrix. By analyzing this matrix, it could determine which business units Apple is likely to invest in heavily, develop selectively, or divest.

The market attractiveness axis would be relatively easy for the competitor to assess if it is currently operating in that market, since this consists of factors external to Apple. This includes easily obtainable information such as the current market size and market growth rate. However, some factors would have to be assessed subjectively, such as barriers to entry and the state of technological development.

In contrast, the business unit strength axis would be more difficult to assess since it consists of factors internal to the company, such as customer loyalty, access to resources, and management strength. However, a great deal of information could be obtained from secondary sources, such as the Internet, the media, and shareholder reports.

Figure 4: Assessment of Apple business units in the GE/McKinsey Matrix

Bcg Matrix Of Reliance Pdf Online

From an assessment of the above GE/McKinsey Matrix, it becomes clear that Apple is at least moderately strong in each of its business units and it competes in a number of attractive and fast-growing segments, such as tablet computers and smartphones. A competitor performing this analysis would realize that Apple is unlikely to divest any of these business units and is likely using its personal computer and music products as cash cows in order to fund R&D and growth in the faster-growing markets. The barriers to entry in all of these markets are considerable, since entry would require a large amount of funding for either R&D or the acquisition of the necessary technology and expertise. If the company performing this analysis decides to compete with Apple, it should do so in the newest, fastest-growing markets (tablets and smartphones), as these represent the areas of greatest opportunity, despite Apple’s early dominance